TRX Price Prediction: Analyzing the Path to $0.66-$1.06 Targets by October 2025

#TRX

- Technical Strength: Price above 20-day MA with Bollinger Band positioning suggesting upward momentum potential

- Fundamental Catalysts: 60% fee reduction enhancing network adoption and stablecoin utility

- Price Targets: Technical setup supports projections toward $0.66-$1.06 range by October 2025 if key resistances are breached

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

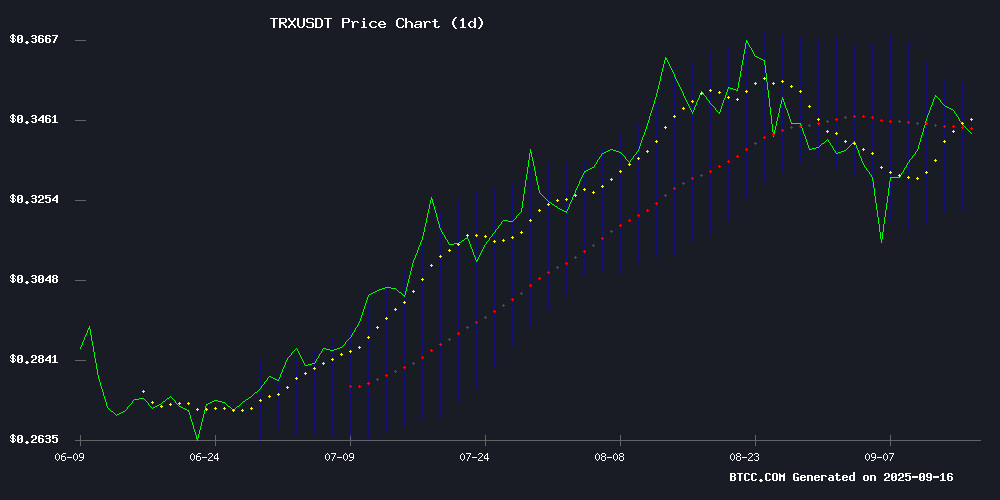

TRX is currently trading at $0.3446, positioned above its 20-day moving average of $0.3391, indicating underlying strength. The MACD reading of -0.004445 suggests some near-term bearish momentum, though the price holding above the moving average provides support. Bollinger Bands show TRX trading in the upper portion of its recent range between $0.3226 and $0.3557, with the current price approaching the upper band resistance.

According to BTCC financial analyst Ava, 'The technical setup suggests TRX is consolidating above crucial support levels. A sustained break above the $0.3557 resistance could trigger further upside momentum toward higher targets.'

Market Sentiment: TRON's Strategic Moves Fuel Positive Outlook

Recent developments including TRON's 60% fee reduction and growing stablecoin adoption are creating positive fundamental tailwinds. Market resilience shown by both BNB and TRX during volatility periods indicates strong investor confidence. Current price action holding the $0.35 support level aligns with technical analysis suggesting potential for breakout movements.

BTCC financial analyst Ava notes, 'The combination of improved network economics through fee reductions and technical strength above key support levels creates a compelling case for TRX. The market sentiment appears cautiously optimistic as TRON continues to execute on its adoption strategy.'

Factors Influencing TRX's Price

TRON Slashes Fees by 60%, Boosting Stablecoin Adoption

TRON has solidified its position as a leading platform for stablecoin remittances following a decisive 60% reduction in transaction fees. The network's gas price dropped from 210 SUN to 100 SUN on August 29, 2025—the lowest level since 2021—directly countering rising on-chain costs fueled by TRX's price appreciation.

Fee-sensitive users are flocking to the network. Average transaction costs plunged to $0.59 by September 8, creating ideal conditions for high-volume USDT transfers. While daily revenue temporarily dipped from $13.9 million to $5 million, the strategic tradeoff is clear: TRON prioritizes long-term ecosystem growth over short-term monetization.

Network metrics tell the story of successful adoption. Block activity and stablecoin transaction volumes are climbing steadily, proving that competitive fee structures remain a powerful lever in blockchain's infrastructure wars. The move positions TRON as a cost-efficient alternative for both retail users and institutional payment corridors.

BNB and TRX Show Resilience Amid Market Volatility

Binance Coin (BNB) and Tron (TRX) continue to demonstrate relative strength in the cryptocurrency market. While most altcoins struggle to maintain momentum during pullbacks, these two assets have shown notable resilience. BNB's recent rejection from an ascending trendline at $917 has traders watching key Fibonacci levels for potential reversals.

The 4-hour chart reveals BNB testing the 0.382 Fibonacci level after failing to break above its trendline. Technical indicators suggest upside potential may emerge within days, with the Stochastic RSI approaching oversold territory across multiple time frames. The weekly chart paints a more bullish picture, with BNB maintaining an ascending trendline dating back to 2021.

TRX mirrors this stability, consistently outperforming peers during both rallies and corrections. Market makers appear to be supporting these assets, though Bitcoin's movements could still trigger deeper retracements. For BNB, the 0.618 Fibonacci level near previous swing highs remains critical support if downward pressure intensifies.

TRON (TRX) Holds $0.35 Support as Bulls Eye Breakout Above Key Resistance

TRX price hovers at $0.35, showing resilience despite a minor 1.31% dip over 24 hours. Technical indicators paint a cautiously optimistic picture—the MACD histogram flashes bullish at 0.0014 while RSI lingers neutrally at 53.27, suggesting room for upward momentum. Market participants now watch the $0.37 resistance level as the next battleground.

Absent major fundamental catalysts, TRON's price action remains driven by technical dynamics. The quiet period has allowed chart patterns to dominate, offering traders cleaner signals without news-induced volatility. Such conditions often precede decisive moves when combined with building momentum indicators.

TRX Price Prediction: TRON Targets $0.66-$1.06 by October 2025 Amid Strong Technical Setup

TRON (TRX) is poised for significant upside, with technical indicators signaling bullish momentum toward a $0.66-$1.06 range by October 2025. The cryptocurrency, currently trading at $0.35, has demonstrated robust price action, defying near-term consolidation risks.

Analyst consensus remains overwhelmingly optimistic. CoinCodex projects a conservative $0.356 target by early October, while CoinCu's forecast of $0.6624 reflects expectations of sustained upward trajectory. The most aggressive predictions suggest triple-digit percentage gains from current levels.

Key technical levels include immediate support at $0.30 and resistance at the 52-week high of $0.37. A breakout above this threshold could accelerate the climb toward higher targets.

Is TRX a good investment?

Based on current technical indicators and fundamental developments, TRX presents an interesting investment opportunity. The price holding above the 20-day moving average at $0.3391, combined with TRON's recent 60% fee reduction that enhances network utility, creates a positive setup.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.3446 | Above MA Support |

| 20-Day MA | $0.3391 | Bullish |

| Bollinger Upper | $0.3557 | Resistance Level |

| MACD | -0.004445 | Watch for Crossover |

The key resistance at $0.3557 represents the immediate hurdle, with successful breach potentially opening the path toward the $0.66-$1.06 projection range by October 2025. However, investors should monitor MACD for bullish crossover confirmation and consider market volatility in their position sizing.